Categories: Customer Service, Inventory Management

By Mark Tomalonis

Principal, WarehouseTWO, LLC

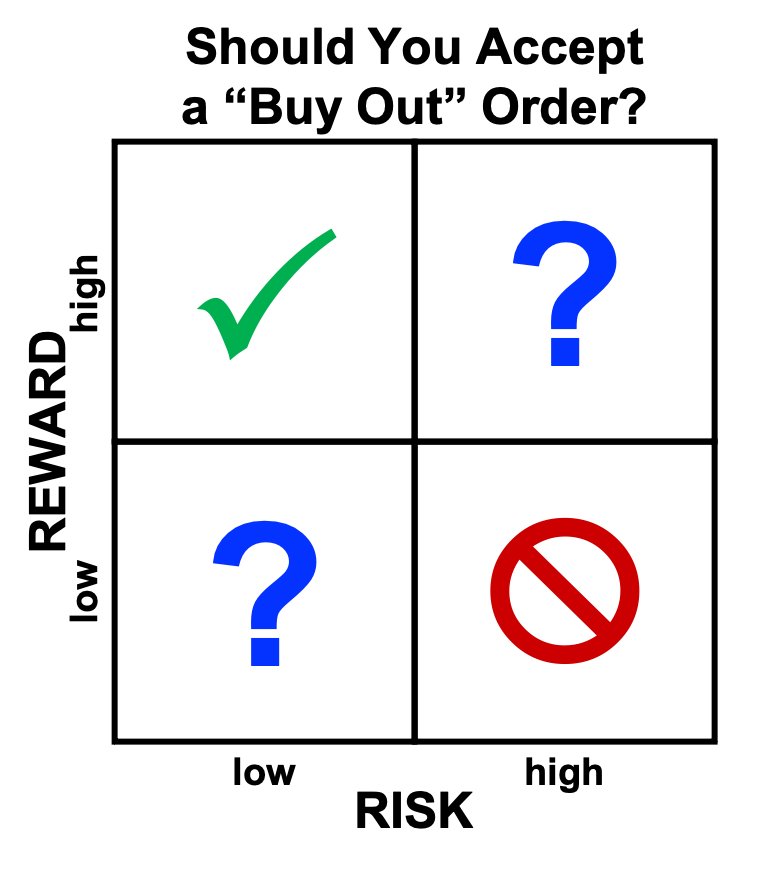

You just got an inquiry for an item made by a manufacturer for which your company does not have a formal relationship. That is, you will have to "buy out" this item from another supplier, or possibly from another distributor. Should you accept the order? If so, what are the rewards and risks of processing an order for a "buy out" item?

You just got an inquiry for an item made by a manufacturer for which your company does not have a formal relationship. That is, you will have to "buy out" this item from another supplier, or possibly from another distributor. Should you accept the order? If so, what are the rewards and risks of processing an order for a "buy out" item?

In my experience there are four reasons why your customer wants to give you an order for a "buy out" item:

A sales order for a "buy out" item is different from a sale for a stocked item in terms of its rewards and risks:

The rewards

The risks

Even if the risks of processing the sale of a "buy out" item are low, your costs of handling the transaction are higher than those associated with selling a stocked item. Those increased costs can include:

Considering the risks and extra costs of accepting an order a "buy out" item, you may want to turn the order down, and instead redirect the customer to a an alternative supplier who has a formal relationship with the item's manufacturer.

If you decide to accept an order for a "buy out" item, you should make a significantly-above-average profit on the sale. A simple rule-of-thumb: double the acquisition cost. Justifications for such a mark-up:

To protect your company from having to take back a pricy "buy out" item because the customer wants to return it, consider implementing an "exceptional order acceptance" policy. To learn more about such a policy, and to download our "Exceptional Order Acceptance Form", read our article, Your Customer Wants to Return WHAT???.

Inevitably, you may be asked to take back a "buy out" item from the customer. Does your company's QA process capture the reasons behind every item return ("buy out" or otherwise)? And does your process flag every return that is for a "buy out" item? If so, what percent of all line items sold are returned, and what percent of all "buy out" items sold are returned? These are good metrics to compare to help you determine whether or not you should impose an "Exceptional Order Acceptance" policy.

Got a question or comment about this article? Email me.

About the Author After a successful career in sales and operations management in the wholesale-distribution industry, Mark Tomalonis is now principal of WarehouseTWO, LLC. He amuses himself by writing articles, such as this one, to help manufacturers and wholesaler-distributors execute their operations better. Mark’s articles and tips are published in WarehouseTWO’s monthly e-newsletters. Click here to subscribe.

After a successful career in sales and operations management in the wholesale-distribution industry, Mark Tomalonis is now principal of WarehouseTWO, LLC. He amuses himself by writing articles, such as this one, to help manufacturers and wholesaler-distributors execute their operations better. Mark’s articles and tips are published in WarehouseTWO’s monthly e-newsletters. Click here to subscribe.

About WarehouseTWO

WarehouseTWO, LLC is an independent “inventory-pooling” service created exclusively for durable goods manufacturers and their authorized distributors, and for any group of durable goods “peer” wholesaler-distributors, such as members of a buying/marketing group or cooperative. To learn how inventory-pooling with WarehouseTWO can help your business, visit the WarehouseTWO website, or email info@warehousetwo.com.