Categories: Management

By Robert L. Day

Managing Partner, WeAudit.com

.jpg) Everyone is aware of the obvious financial impact of the coronavirus on your business. The virus affects it in many ways, and the worst is still to come.

Everyone is aware of the obvious financial impact of the coronavirus on your business. The virus affects it in many ways, and the worst is still to come.

It will be months, if not over a year, before we see some normalcy return and the fear subside.

However, what most businesses don't think about is how this impacts credit card processors. More importantly, why should they care? Well, if it were a fair game we wouldn’t need to worry about how processors will weather the storm. But it is not even close to a fair game!

Processors have some major advantages to help them make up lost revenue from slow sales. They will be paid the same, regardless of your sales which may be cut in half, assuming you’re one of the lucky ones seeing only a 50% reduction and you’re not completely shut down.

First, credit card processors have open, unvalidated access to your business checking account.

Second, there is virtually no government oversight that regulates them. In short, processors can pay their bills by taking extra money out of your bank account.

Think not? Then keep reading as we show you just how they do it!

No doubt people will lose cars, homes, and more, and default on many loans. Yet, when you look at the bank's year-end report, their profits will be as strong as ever. How? Was it the total free checking or the 2% loans? Most banking products are not just regulated, they are heavily regulated. But with the lack of oversight on merchant accounts, the banks/processors can add bogus, made-up fees, over-inflate the interchange, and more.

I'm writing this article on March 20th, 2020 and we have already seen the credit card processors become more aggressive by raising fees and creating new ones.

Visa just announced one of the largest interchange rate bumps I have seen in over 20 years, even though they made just under 23 billion last year! They obviously think they needed a little or, should I say, a lot more!

To “help” merchants, one of the largest processors just announced that they are going to change their statements to make it easier for merchants to understand (see removing interchange fees below). That's code for we are going to remove the details. Yes, fewer numbers and fewer details do make for an easier read, but this new policy is designed to keep you from being able to truly understand what the credit card processor is actually billing you for. I think we can all agree, the processor who is making over 10 billion a year is not really trying to help you (as the merchant) have a total grasp of the fees you are being forced to pay. Let me put this another way. Would you go to the grocery store and get a receipt for $185 without any details and think that is ok? Or would you want the receipt to show exactly what you paid for that box of Cap'n Crunch? I think we all can agree, when you are doing the right thing you don’t hide it! You point to it!

Just this month we have seen a large uptick in credit card processors:

The list above is not new; it’s not even a full list. See below for a better explanation and examples.

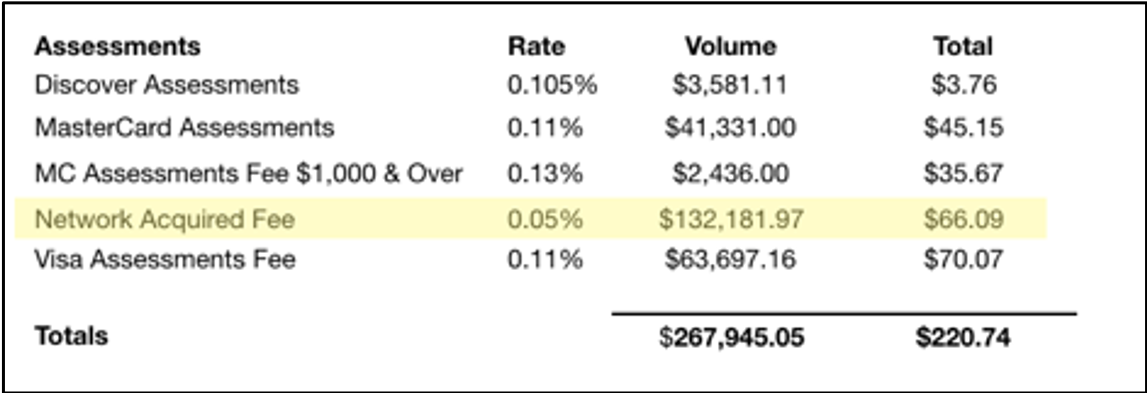

The processor has made up a new fee called “Network Acquired Fee.” Since the processor places this in the Assessments section of their statement, it gives the illusion that the fee was from Visa or MasterCard.

If you do a web search for "Network Acquired Fee," you get "Visa Fixed Network Acquired Fee." The processor’s trick here is to use a made-up fee that sounds like a real fee. However, the two fees have nothing to do with one another. One is a real fee from Visa, and the other is simply made up by the processor as they hide their extra charges for the transaction. This is just one of the dozens of made-up fees we find being added.

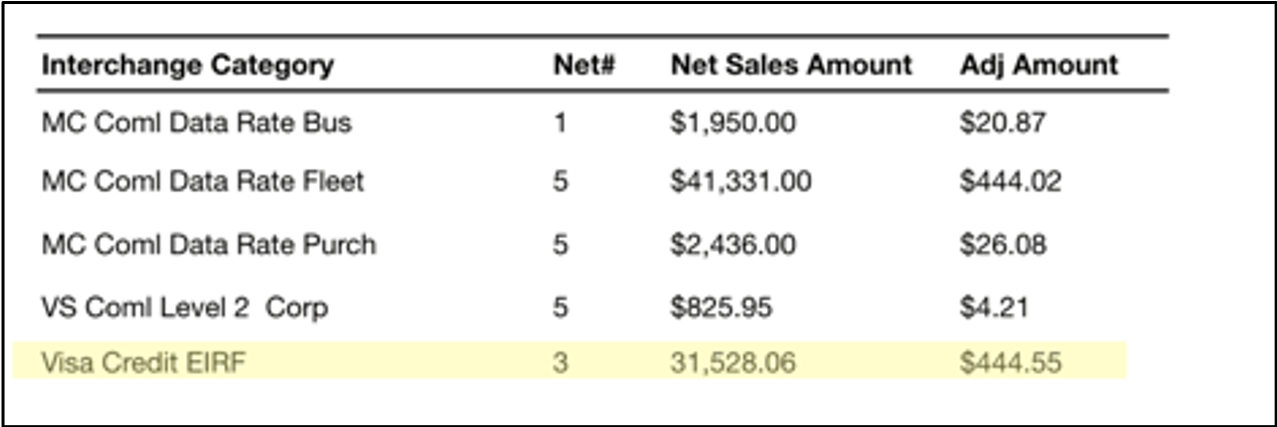

Visa charged the merchant 0.76% for the transaction that qualified as EIRF Interchange 0.76%. But when you divide $31,528.06 by $444.55, it comes out to 1.41%. The processor is adding an additional 0.65% on top of Visa’s 0.76% Interchange rate. The merchant has no idea that the processor is making this extra profit and just assumes Visa is charging them 1.41%. To make this harder to spot, the credit card processor does not show the 1.41%. You must do the math, and then try to find the correct interchange category to see if it matches. Now do this on hundreds of transactions. The processor knows this is by far the easiest way to steal from the merchant without getting caught.

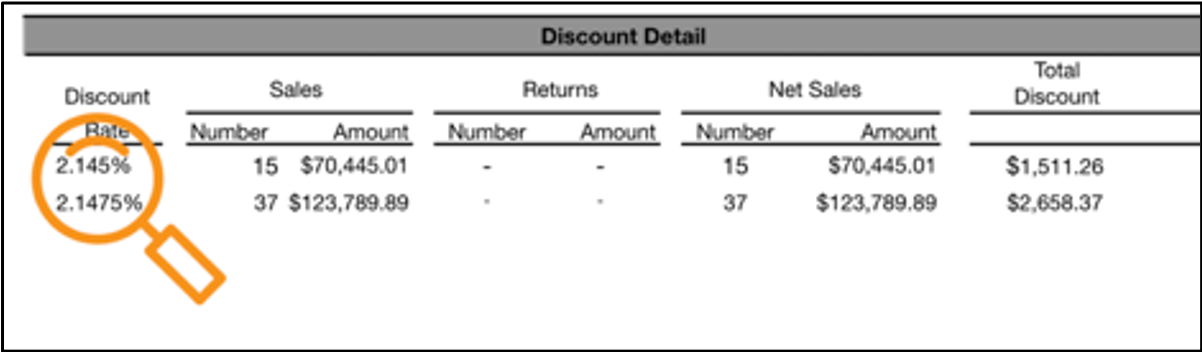

The key here is being able to see your discount rate. If you can’t see it, how will you know if they raised it?

Below, the credit card processor bundled the merchant’s discount rate, which is why the discount looks so high. If your discount rate is over 1%, then it is bundled, or you have a beyond high discount rate. Your discount rate should be .07% or less.

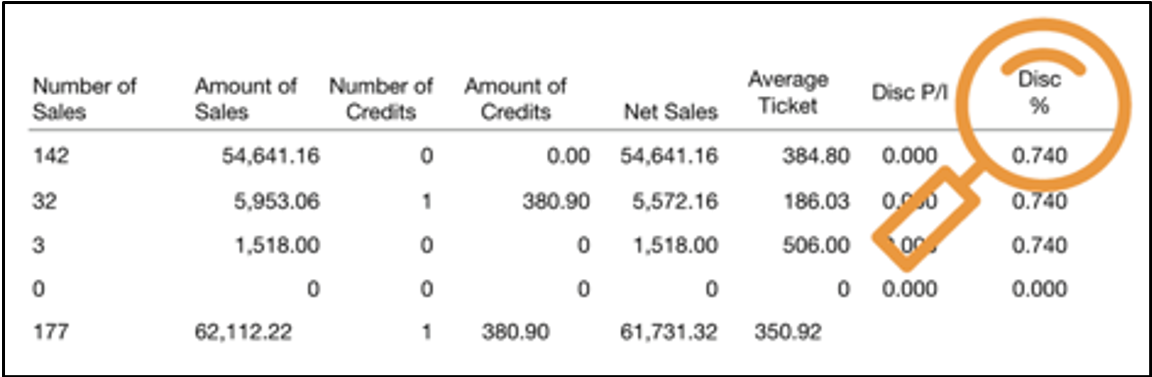

Below is an example of a discount rate that is not bundled, but again, it’s very high! The credit card processor will charge as much as they can. Again, virtually no oversight leads to excessive over-billing!

The Durbin Swipe Fee Amendment requires issuing banks to reduce the Interchange fee to 0.05% to the credit card processor on Regulated Debit Cards. However, there’s nothing in the law that requires the processor to lower fees to the merchant.

Many merchants are not aware of this law. Or if they do know about it, they don’t know that the rates are only 0.05%, and non-regulated debit cards are only .80% - 1.65%. Therefore, many processors may give some of the interchange reduction back, but many will just keep the difference and charge the debit card a credit card rate and keep the difference in fees for themselves.

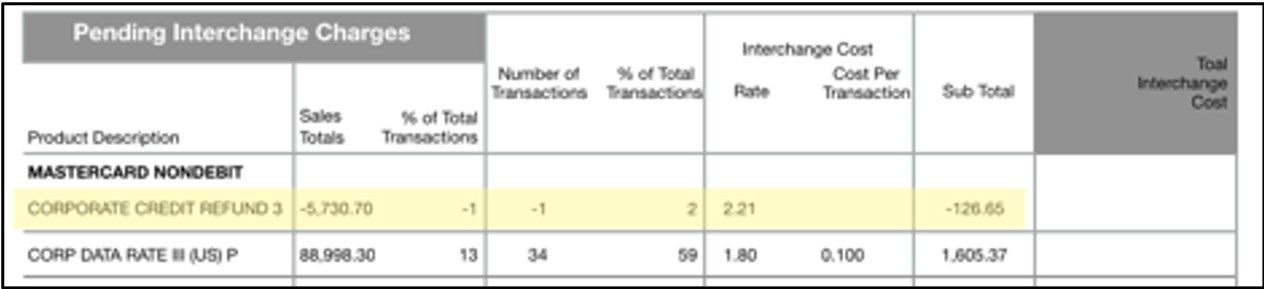

When merchants post refunds, the processing networks (Visa, MasterCard & Discover) return the Interchange to the credit card processor, but most merchants are not aware that money is due back to them. Therefore, the processor can just pocket the money.

Above, you will see the merchant had $5,730.70 in returns, and the processor properly credits the merchant the 2.21% Interchange Rebate. However, if you are not getting your rebate, you will not see a line item on your statement to show this. And because processors know that most merchants don’t know they are supposed to receive this rebate, they most often just keep it!

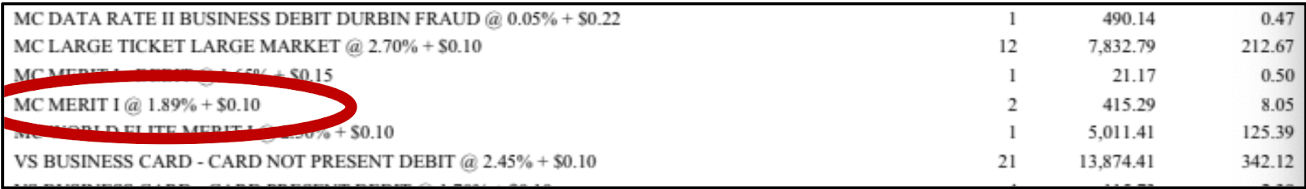

Below you will see the credit card processor charged 1.89% for the MC Merit I transaction.

This month, the credit card processor removed the interchange rate, so now how do you know if they charged you the correct interchange rate? The processor said they removed the rate to make it easier for you to understand. Really?

You would like to think that in this critical time in America, it would be a time to lower fees to help American businesses survive this financial storm, not raise them!

If you want to find out if you are being over-billed, go to www.weaudit.com/how-easy-it-is to get a Free audit. If you have questions, you can visit us at www.weaudit.com or call us at 1-800-672-1292.

About the Author

About the Author

Robert L. Day is co-founder and Managing Partner of weAudit.com. With over thirty-five years in the financial industry (twenty of which were in the merchant processing industry), Robert has a wealth of knowledge from working on the inside and behind the scenes of a “closed-door industry”, the credit-card industry.

About weAudit.com

About weAudit.com

weAudit.com is the leading independent auditor of credit card processing fees. With its proven ability to decipher and interpret credit card processing fees, weAudit.com helps its clients reduce the costs of accepting payment by credit card, resulting in measurable improvement in net profitability.